The Data Tells the Story

Gold crossed $4,000 an ounce this week for the first time in history. The world’s oldest store of value has surged 50% in nine months—a move that demands attention.

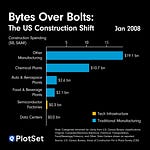

We’ve visualized this historic moment using PlotSet Plus, a premium tool on our professional data visualization platform. PlotSet Plus gives you access to the same powerful visualization tools used by major financial institutions—democratizing data storytelling for everyone.

Washington Goes Dark

We’re a week into another government shutdown—the 11th since 1980. The September jobs report never arrived. Inflation data has gone dark. The Federal Reserve faces a policy meeting in three weeks without the data it needs. The CFTC has stopped publishing positioning reports.

Investors have fled to gold because it needs no government validation. No quarterly earnings. No Fed pronouncements. Gold simply exists, and that immutability has become increasingly valuable as Washington fails at basic functions.

Central Banks Abandon Ship

While the Nasdaq celebrates AI breakthroughs and hits new records, central banks are quietly rewriting the rules of global finance.

China has bought gold for 18 consecutive months, adding over 300 tonnes. Russia continues accumulating despite sanctions. Poland stunned markets with a single 100-tonne purchase. El Salvador—yes, the Bitcoin country—now buys physical gold for “prudential balance.”

These sovereign nations are systematically reducing dollar exposure. When your biggest Treasury customers prefer gold bars to your bonds, you have a credibility crisis.

The Privilege Crumbles

For seven decades, America enjoyed the dollar’s reserve currency status—an “exorbitant privilege” that allowed Washington to run perpetual deficits and weaponize financial sanctions.

That privilege was earned through stable governance and predictable policy. Each shutdown, each data blackout chips away at the foundation of trust supporting the entire system.

Ray Dalio built the world’s largest hedge fund understanding these dynamics. His message this week was blunt: debt instruments are “not an effective store of wealth.” He wants 15% of portfolios in gold. Bridgewater Associates telling the world to trust rocks over papers means erosion has already begun.

The Numbers Don’t Lie

Goldman Sachs predicts gold will reach $4,900 by end-2026. UBS expects central banks to acquire 900 tonnes this year. These aren’t conspiracy theorists. They’re the heart of global finance betting against American stability.

Want to track these seismic shifts yourself? PlotSet Plus puts institutional-grade data visualization in your hands. Build compelling charts that tell the real story behind the numbers. Start visualizing at PlotSet.com.